long term care insurance washington state tax opt out

1 and state Department of. 2021 opt out of the tax.

The Washington State Long Term Care Trust Act How You Can Opt Out Of The Tax California Long Term Care Insurance Services

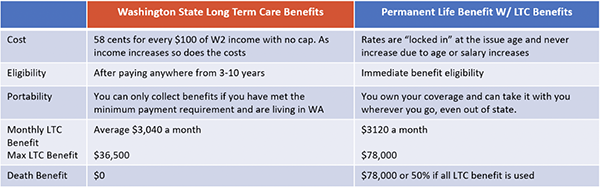

Washington employees must contribute a new payroll tax called the Washington Long-Term Care Tax to tax peoples wages to pay for long-term care benefits.

. It is too late. WHAT IS THE TAX. Candice Bock Matt Doumit.

1 every employee will pay 58 cents. It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax. Opting out of the tax must be done by November 1 2021 and you must buy qualified private long-term care.

There is no indication. How do I opt out of WA cares. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program.

Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021. 26 2021 inviting passersby to come in and ask questions about. You have one opportunity to opt out of the program by having a long-term.

State Mandates Politics has played into rising demand as well. If passed it will permit long-term-care insurance premiums to be paid directly from. The one way to opt out is for people who have a private long-term-care insurance policy.

Back in 2019 the state passed a law to fund a public long-term care program through a mandatory payroll tax on every W-2 employee. This means that if you purchased a private long-term care policy that you should not cancel it. Time has run out.

The only exception is to opt out by purchasing. A sandwich board sits outside an insurance brokers office in Seattles Fremont neighborhood on Aug. When was Long Term Care Insurance introduced.

1980s Long-term care insurance was first offered in the early 1980s and the market grew rapidly for two decades. Heres how it works and how you can opt out. Under current law Washington residents have one opportunity to opt out of this tax.

Private insurers may deny coverage based on age or health status. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC. Up until the law was changed in March 2022 the only workers in Washington who were exempted from the program were those who owned long-term care insurance with an.

The program which will be funded by a mandatory payroll tax will help pay for eligible long-term care-related expenses. A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and. You must also currently reside in the State of Washington when you need care.

You needed to apply earlier to have coverage in place by. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage. Lets assume for the.

WA Cares Fund is an earned long-term care benefit for Washington workers. The Washington State Legislature established a long. The deadline to have one as mentioned is before Nov.

Applications are available as of October 1 2021. Long-term care insurance LTC or LTCI is an insurance policy provided in the United States the United Kingdom and Canada that helps pay for long-term. The tax has not been repealed it has been delayed.

Learn about earning your benefits and how to apply here. The Window to Opt-Out. For more on long term care insurance read Long Term Care Insurance 101 and Hybrid Long Term Care Insurance An Upgrade on.

Those choosing not to participate in the long-term care tax needed to have a long-term insurance plan in place by 1112021 if they wish to opt-out.

Long Term Care Insurance Washington State S New Law White Coat Investor

Long Term Care Benefit Through Chubb Afscme Council 28 Wfse

Time Expiring For Washington Residents In 30s And 40s To Avoid New Tax American Association For Long Term Care Insurance

Washington State Delays Public Long Term Care Insurance Until April Explores Changes

How Do You Opt Out Of Washington State S Long Term Care Tax Avier Wealth Advisors

What You Need To Know About Washington State S Public Long Term Care Insurance Program

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety

What To Know Washington State S Long Term Care Insurance

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Long Term Care State Payroll Tax Update Buddyins

Thousands Of Washingtonians Look To Opt Out Of Long Term Care Insurance Tax Business Daily News Mcknight S Senior Living

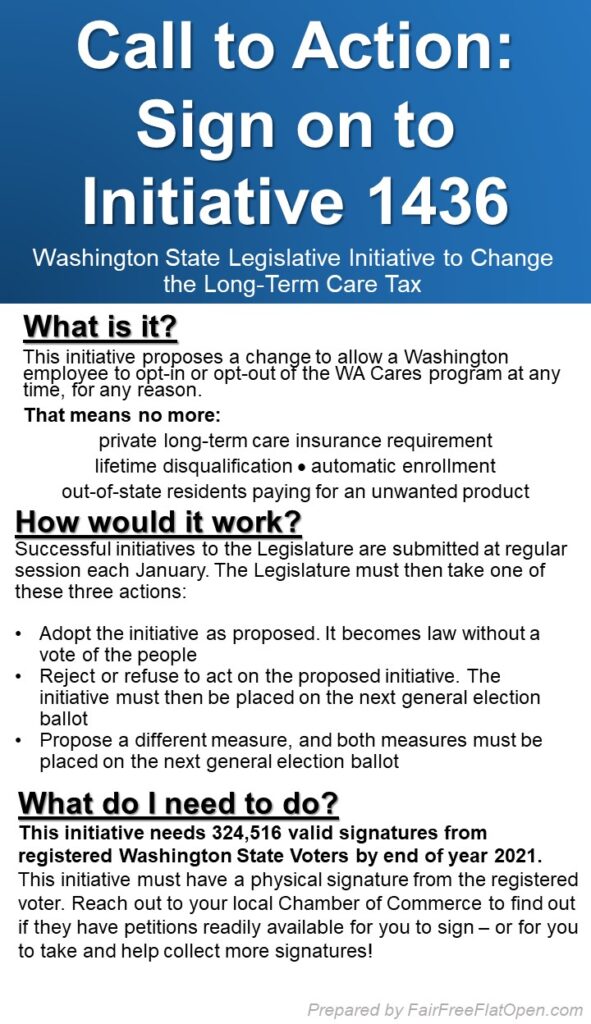

Opening Day Woe And Initiative Weal Washington State Ltc Opt Out A Bust But Initiative Gathers Steam Fair Free Flat Open

Your Only Chance To Opt Out Of Washington S New Long Term Care Tax Is Fast Approaching Puget Sound Business Journal

Washington Long Term Care Insurance Detailed Guide Trusted Choice

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

Kuow Washington House Votes To Delay Long Term Care Tax For 18 Months

Ltc Insurance What Is The Long Term Care Tax In Washington State King5 Com

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire